Zero-Ad-Spend Funnels: Turning Organic Traffic Into Booked Discovery Calls

Independent advisors hear a lot about “funnels,” but most examples assume big ad budgets. In reality, many successful RIAs are building predictable, lean funnels using only their website, content, and email—no paid media required.

Why no-ad funnels matter for advisors

High-growth advisors are leaning into digital systems, not just more ad spend. Those with a defined marketing strategy generate significantly more website leads and onboard more new clients per year than peers without one. At the same time, affluent and high-net-worth prospects are now researching advisors online before ever reaching out, judging them by their digital experience and authority.

A zero-ad funnel lets you intercept that research, guide visitors through a clear journey, and end with booked discovery calls—without the volatility and cost of paid campaigns.

The anatomy of a zero-ad funnel

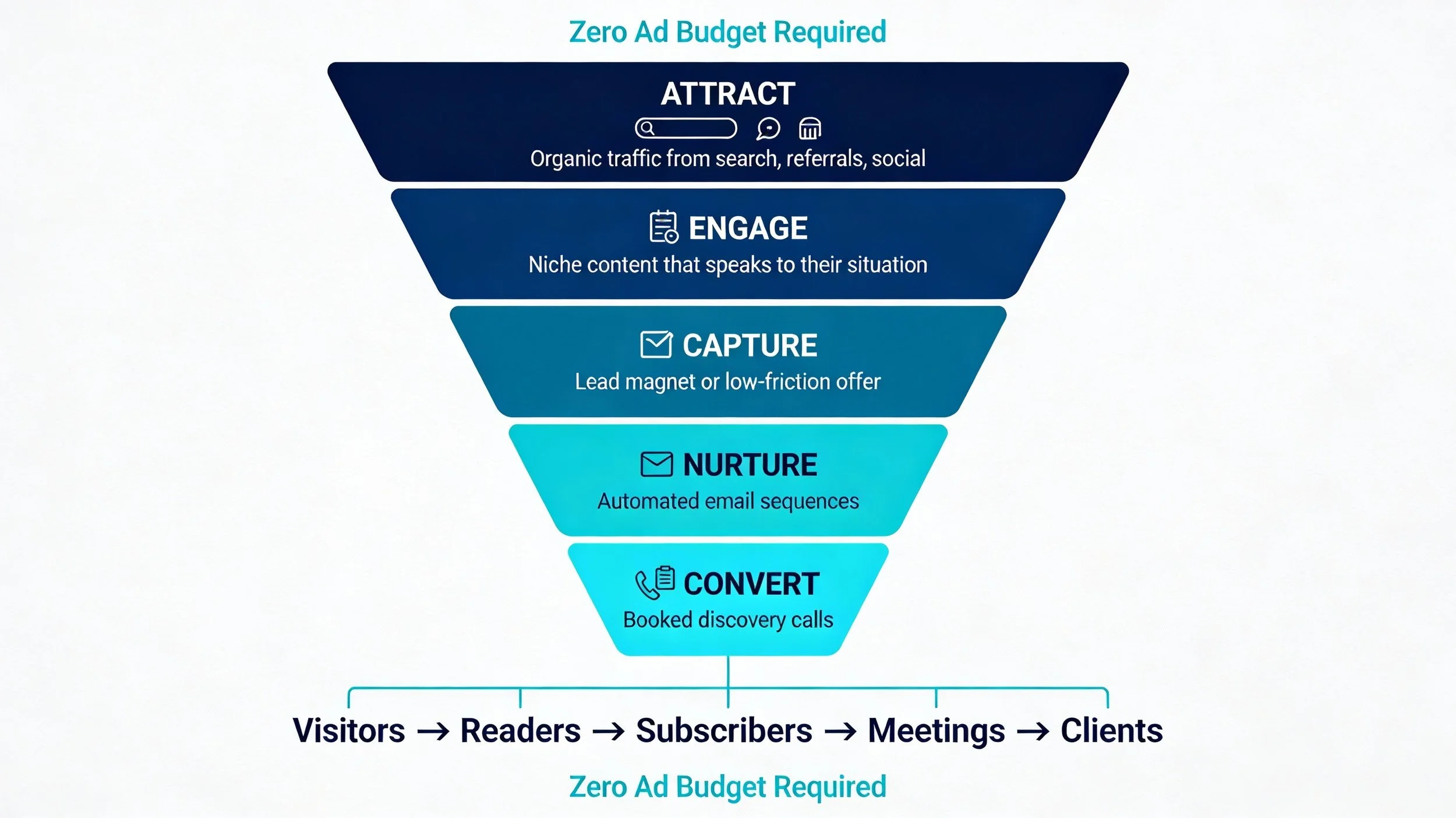

Think of your funnel in four simple stages:

Attract – Organic traffic from search, referrals, social, and directories lands on your site.

Engage – Visitors consume niche content that speaks to their specific situation.

Capture – A compelling offer (lead magnet or low-friction call) collects emails or appointments.

Nurture → Convert – Automated follow-up moves warm leads into booked meetings.

A useful visual here is a simple funnel graphic labeled: “Visitors → Readers → Subscribers → Meetings → Clients.”

Step 1: Attract with the right traffic

Organic traffic is not just about volume; it is about fit. Advisors who publish regular, niche content—like equity comp planning for tech employees or retirement planning for physicians—attract fewer but much more qualified visitors.

Focus on:

SEO basics: Clear service pages, targeted keywords (“fee-only advisor for business owners”), and descriptive meta descriptions.

Strategic directories: NAP consistency (name, address, phone) and niche listings (e.g., fee-only networks) that point back to your site.

“Help content”: Blog posts and guides that answer the questions ideal clients actually type into Google.

Step 2: Engage with niche, problem-solving content

Once visitors arrive, content keeps them on the site and builds trust. Research on financial buyers shows that prospects often consume several pieces of content before engaging a professional, especially for high-stakes decisions like choosing an advisor.

Design your content around:

Trigger events: Business sale, inheritance, liquidity events, retirement timelines, or stock option vesting.

Emotional stakes: Fear of missing out, anxiety about taxes, desire for legacy, or pressure to “catch up.”

Clear outcomes: “How to walk away from your business sale with confidence about your family’s lifestyle.”

Every article should naturally point to the next step in the funnel.

Step 3: Capture leads with an irresistible offer

Most visitors will not book a call the first time. A lead magnet bridges the gap between “just browsing” and “ready to talk.”

For advisors, strong offers include:

A downloadable checklist (“10 Questions to Answer Before You Sell Your Business”)

A short scorecard (“Are You On Track for a Work-Optional Life by 60?”)

A mini-guide tailored to a niche (“Equity Comp Playbook for Senior Engineers”)

Place the offer:

As an in-article content upgrade (banner or in-line opt-in).

In your sidebar and footer.

On your homepage and niche landing pages.

The goal is to convert anonymous visitors into known contacts who have signaled interest in a specific topic.

Step 4: Nurture with email and convert to meetings

When a prospect opts in, an automated email sequence should kick in. Many advisors who add a simple 3–5 email nurture series see a meaningful lift in booked calls, because the sequence keeps the conversation going and reduces friction.

A practical email sequence:

Deliver the promised resource and set expectations.

Share a relevant story (anonymized) illustrating the problem and solution.

Offer a short educational video or FAQ that addresses common objections.

Invite them to a low-pressure, 20–30 minute “fit call.”

Each email: one idea, one clear call to action.

Step 5: Remove friction from booking

Even with interest, people procrastinate. Advisors with streamlined booking processes see more conversions from warm leads.

Key moves:

Use an online scheduler so prospects can book instantly.

Offer two formats: video call and phone.

Confirm via email and calendar invite, with a brief agenda and what to prepare.

This turns your funnel into a repeatable path: a stranger discovers your content, relates to your stories, receives value, and can book a call in a couple of clicks.

A brief advisor story

One independent advisor serving closely held business owners set up a zero-ad funnel centered on an “Exit Readiness Scorecard.” Within six months, the site averaged a modest but targeted 800–1,000 monthly visitors, with 4–6 new scorecard opt-ins a week and 2–3 booked calls from organic traffic alone. The advisor invested no money in ads—only in content, email automation, and a clear process.